Getting Off the VC Train

I've talked to a lot of founders who have raised money and are now thinking of getting off the venture capital train if they can.

One of the most common conversations I’ve had with venture-backed founders in my network lately is the idea of getting off the VC train. For various reasons, many founders who have raised venture capital want to get off the VC train. They have said something to the effect of the following:

I want to get off the VC train - what do I do?

To be clear, I am talking about founders I know who have previously convinced themselves and some investors that they are building a company that fits the venture capital model; these companies have already been funded and are aware of how venture capital works and the expectations that come with the money they’ve raised. This is not a conversation I’m having with bootstrapped founders or people who tried and failed to raise venture capital; the founders I’m talking about are very much in the VC-funded company ecosystem and are aware of how it works. I’ve been trying very hard to listen to what these founders are saying and what motivates them to get off the train. After being a part of many of these conversations, I can summarize what they mean in fairly simple terms:

For these founders, “getting off the train” means decoupling the company’s success from the need to raise future rounds of venture capital and no longer measuring their success by the ability to continue to fundraise to fuel growth.

Given how the fundraising markets have changed in the last few years, I understand the desire to get off the train. The venture capital market in 2020 and 2021 was one of the most open markets I’ve seen in my career, and many (but by no means all) talented founders had access to capital on founder-friendly terms. We then went through a period in late 2021 and most of 2022 where access to capital was extremely limited for almost all companies unless you had supportive existing investors. In 2023, the markets have felt selectively open to companies building in AI, companies that are leaders in their category, or otherwise building something unique and interesting to VC investors. For the average company, the last 12-24 months have been a very challenging fundraising environment. And, as far as I can tell, very few people are in a position to confidently state what the venture funding market will look like in 2024, and I have no predictions to share on that front.

Given the recent volatility in the venture funding environment, I understand founders' hesitation about staying on the VC train. To do so means you're putting the future viability of your company at risk based on what the preferences and interests of venture capitalists will be 12 to 24 months from today. This can be scary whether you’re in a category that’s currently in favor and might lose its luster or if you’re in a category that’s currently out of favor and might later be in favor. It’s hard to predict where the market will be and what investors will value. But where the markets are when you need to raise money is a risk that comes with relying on venture capital to fund the next phase of your business.

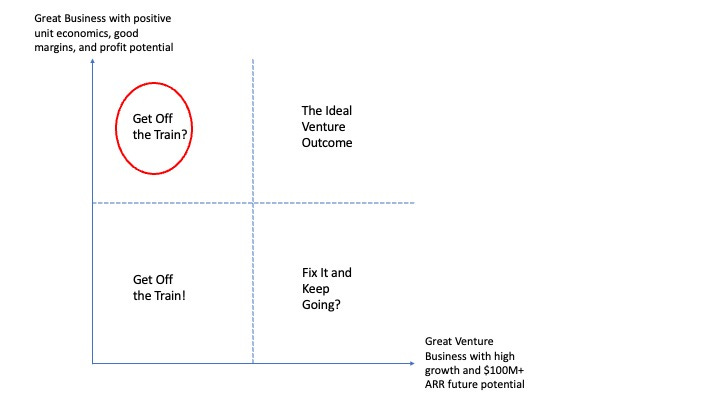

I approach most of these conversations with founders with a simple question - is getting off the train a choice, an option, or a necessity given the state of the business. There are some businesses that require meaningful investment in the early days to eventually build a big business in the end - many of those businesses need venture dollars to fund growth, so getting off the train isn’t really an option for them. For many other businesses, though, venture capital can accelerate growth beyond what the company can achieve without it, and it’s worth considering that funding as an option. I think most businesses I meet can be broadly grouped into four categories once you know something about how the business actually works once it’s live and you have data:

All businesses exist on a spectrum and this 2x2 just reduces the complexity of the real world into something easier to generalize. I think the answer to whether to get off the train really depends on the kind of company you have. If you have a business that is no longer a fit for the venture model and doesn’t have near-term prospects for good unit economics, you have to get off the venture train and figure out if the business you’re working on is viable. If you have a business that has really good unit economics, can get profitable, and grow, you might want to seriously consider getting off the train. This is particularly true if you are in a category where investors do not have a lot of enthusiasm for your category. Taking your own destiny into your own hands might be the right answer for you. My big takeaway from having had many of these conversations that the choice to stay on the train really requires evidence or a belief that you’re pursuing an opportunity that really fits the kind of outcomes that VCs want to see. If you’re not in one of the rightmost quadrants in the chart above, I would question whether it makes sense for you to stay on the VC train and rely on venture funding for your future financing needs.

The other thing I’ve started to ask founders is their reason for wanting to get off the train. In the end, I really want to know what’s pushing them in this direction. I find most answers fall into one of three buckets:

Clear recognition that the original thesis was wrong - After working on the problem and talking to customers, there isn’t a venture-scale business to be build based on the original thesis or any subsequent pivots. I find that these conversations are more about whether to keep going or shut down as opposed to staying on the venture treadmill.

Fear of the unknown - Based on the fundraising environment I described above, many founders I know are afraid to risk the fate of their companies on the future state of the fundraising market and the uncertain bar to clear for the next round. While they think they have businesses that should be interesting to VCs, the chance that funding won’t be available in the future is pushing them toward thinking about getting off the train. I generally think that operating from a place of fear is not a great way to run a company, but I also can’t argue with the costs facing those who get the future fundraising market wrong. But sometimes just acknowledging that a decision is being motivated by fear creates more space to think about whether it is in fact the right decision to make

Desire to control the company’s destiny - I’ve certainly talked to a handful of founders who just want to take reliance on outside funding off the table and control their own destiny. They want to cut the cord and find other ways to fund the business and they believe they can get to a good outcome without raising any more money.

I suspect that I will be part of many more of these conversations in the coming quarters and I think all founders should think about what makes sense given what they know about their businesses today and what they think the future holds.

Very well articulated article. Thank you for writing. Do you think this has come from VCs changing their narrative from "grow, grow, grow" to "growth, margin, and burn" for existing companies?

It seems like a self-fulfilling prophecy. The expectations some VCs are sharing with founders they invested in are more aligned with how boostrapped companies operate. At the end of the day, it's difficult to build a business to build a business versus building a business to fundraise.

Great article, Charles! I'm thinking through a model to help some of these startups that want to get off the VC train.